Why Full-Time Leadership Isn’t Always the Default

Traditionally, growing businesses filled C-suite positions with full-time executives. But in 2025, several trends are reshaping this approach:

1. Capital Efficiency Matters Most

Investors now prioritize lean operations. Full-time executives with high salaries and benefits may strain budgets. Fractional leaders provide top-tier expertise without long-term financial commitments, giving startups flexibility to allocate resources where they matter most.

2. Business Moves Faster Than Hiring Cycles

Full-time executive searches can take 4–6 months, slowing down critical initiatives. Fractional leaders are available within days, offering immediate impact on product launches, infrastructure upgrades, or strategic pivots.

3. The Rise of Portfolio Executives

Experienced leaders increasingly prefer multiple part-time engagements. These fractional executives, often ex-CIOs, CTOs, or COOs, bring diverse experience from multiple industries, helping startups navigate complex challenges faster than traditional hires.

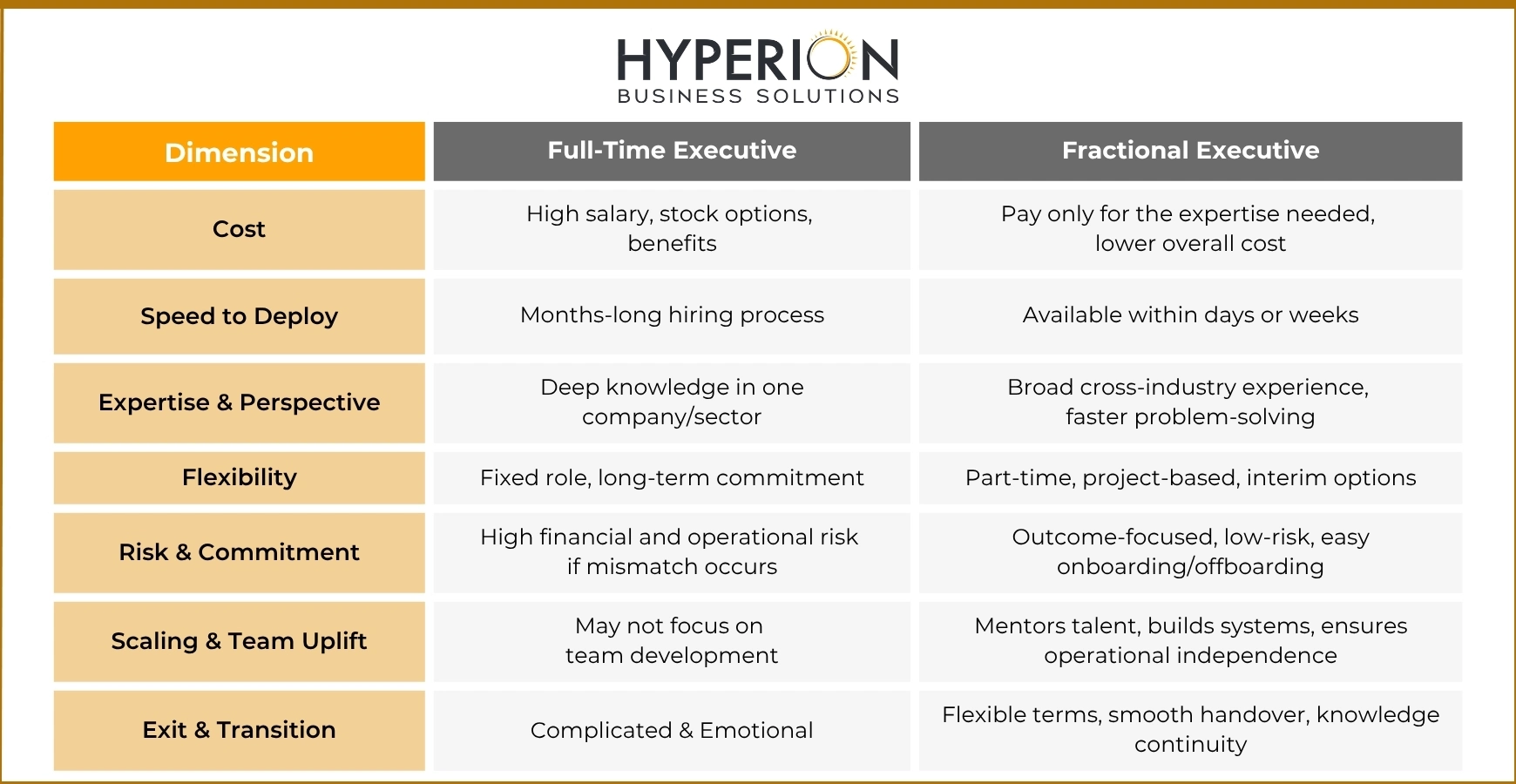

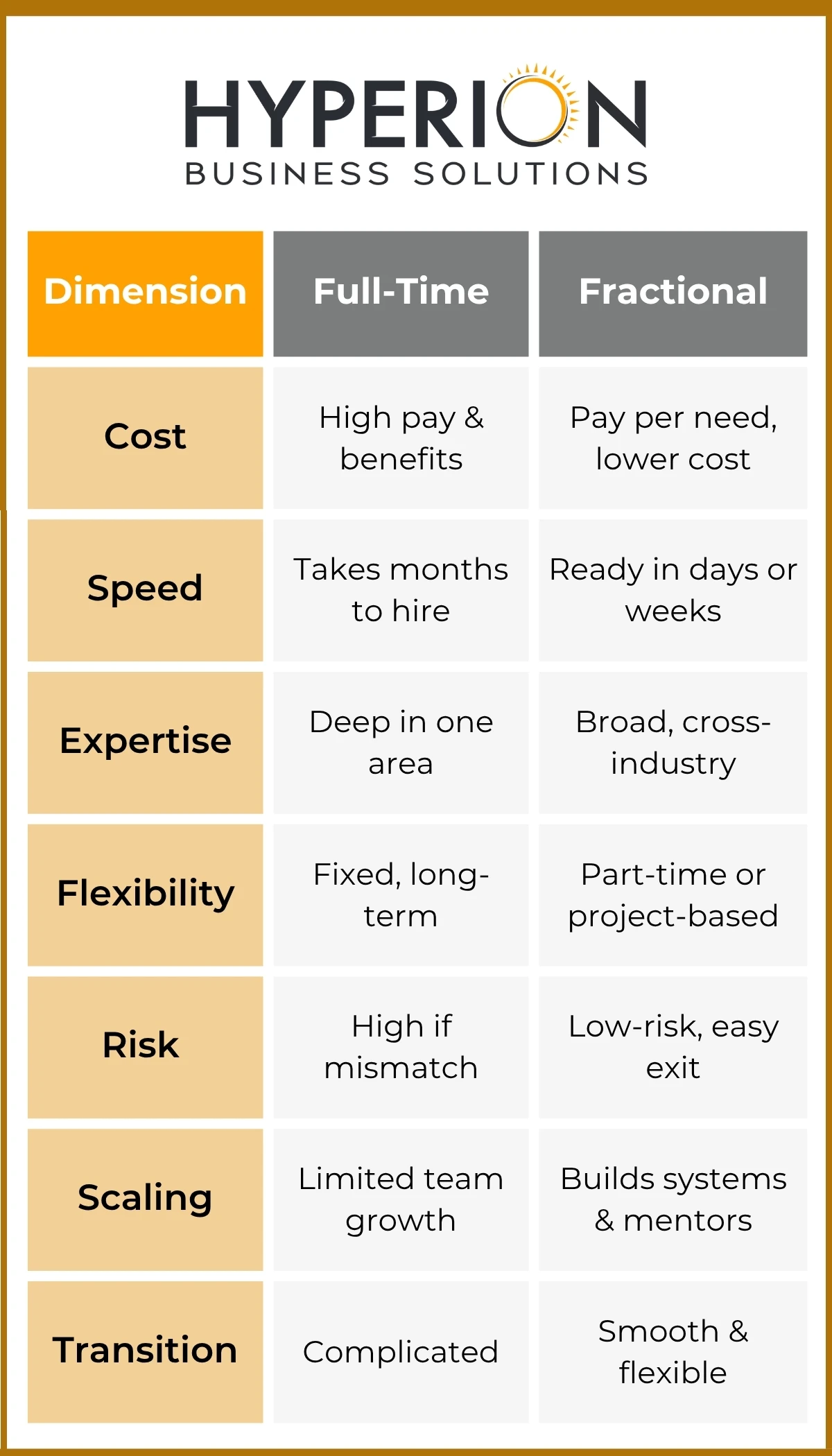

Comparing Fractional and Full-Time Executives

When to Consider Fractional Leadership

Fractional executives are ideal for businesses that:

- Are early-stage or in Series A/B growth

- Need specialized skills for transformation or technical debt

- Are preparing for audits, investments, or enterprise clients

- Want to test executive decisions before a long-term hire

- Need mentorship for early or junior talent

When Full-Time Leaders Are Still the Right Choice

Full-time executives remain valuable when:

- Your company is post-Series C with stable operations

- Long-term internal culture and integration are critical

- Roles require constant stakeholder or regulatory presence

- You’ve found a leader who aligns with long-term growth goals

Final Thoughts: ROI in 2025 Executive Hiring

The smartest companies no longer default to tradition. The real ROI comes from choosing the right leadership model for the immediate growth stage. Fractional executives offer fast, flexible, and capital-efficient leadership, helping teams scale smarter while full-time leaders provide consistency and long-term cultural impact.

Hyperion Business Solution helps startups and SMEs identify the best executive strategy. Whether you need a fractional CIO/CTO to accelerate growth or guidance on full-time hires, Hyperion Business Solution is your partner in building sustainable leadership.